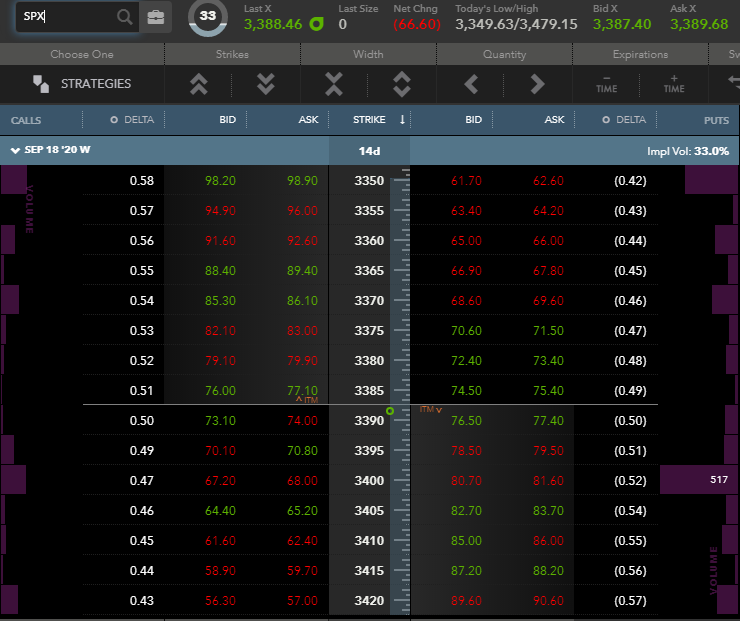

04/11/ · Index options usually have a contract multiplier of $, meaning that the price of an index option equals the quoted premium times $ Unlike options in shares of stock or even commodities, it's not possible to physically deliver the underlying index to the purchaser of an index option. Thus, index options settle via cash payments Besides common stock, there are also options for stock indexes, foreign exchange, agricultural commodities, precious metals, and interest rate futures Example of Index Options: The most popular index is the SP Index contract that trades with the ticker SPX. Here's a List of Most Active Index Options: DJX - Dow Jones Index; IWB - iShares Russell ® Indx Fund; IWD - iShares Russell ® Value Indx Fund; IWF - iShares Russell ® Growth Indx Fund; IWM - iShares Russell ® Indx Fund

Stock Options and Index Options, an Illustrated Introduction with Examples

The index option is a derivative instrument that tracks performances of the entire index and gives the right to buy or sell units of an index at a contracted rate on a certain future date. The underlying index is what differentiates one option from others, e.

Option pricing is the first and ideally the most complex one to do. Pricing means what premium an option buyer is required to pay upfront to assume the right to buy or sell. Option Premium theoretically can be calculated using a replicating portfolio, using hedge ratios Hedge Ratios The hedge ratio is the open position's hedge ratio's comparative value with the position's aggregate size itself.

Also, it can be the comparative value of the futures contracts purchased or sold with a value stock index options example cash commodity that is being hedged, stock index options example. read more and binomial trees but more advanced methods like Black Scholes Merton pricing formula, Vanna Volga pricing, etc. are used in Financial Markets types Financial Markets Types The term "financial market" refers to the marketplace where activities such as the creation and trading of various financial assets such as bonds, stocks, commodities, currencies, and derivatives take place.

It provides a platform for sellers and buyers to interact stock index options example trade at a price determined by market forces.

read more. The premium paid by option buyer is calculated using various methods. The common inputs for Option Premium calculations are Spot Price, Strike Price, Days to expiry, Stock index options example of Stock price, Risk-free rate of returndividends, if any, etc. Source: quantlabs. The Vanna-Volga pricing model takes BSM one step further and adjusts the above formula for risks associated with volatility.

The main problem associated with the above models in pricing the index options is how to account for the dividends associated with different stocks in the basket of the index. Another way is to use dividend yield Dividend Yield Dividend yield ratio is the ratio stock index options example a company's current dividend to its current share price. It represents the potential return on investment for a given stock.

read more published by data sources like Bloomberg. The Value of the Call Option to the buyer Or seller after the contract till expiry keeps on changing. Depending on that, either party can terminate the options contract by paying cancellation charges as agreed by both parties. The calculation involved in Valuation is similar to the pricing of the option.

Parameters such as volatility, time to expiry risk-free rate of return keeps on changing depending on how financial markets are working. Assume, Firm A need to invest in the Dow Jones index DJX after one month.

Another Firm B is bearish Bearish Bearish market refers to an opinion where the stock market is likely to go down or correct shortly.

It is predicted in consideration of events that are happening or are bound to happen which would drag down the prices of the stocks in the market.

Index options can be used for hedging a portfolio of individual stocks or for speculating the future movement of the index. Investors can implement various option trading strategies Option Trading Strategies Options Trading refers to a situation where the trader can purchase or sell a security at a particular rate within a specific period.

read more with index options viz, stock index options example. Bull spreadsbear spreads Bear Spreads Bear Spread is the price spread where you buy either call or put options at different Strike Prices having the same expiration date. It is used when an investor believes that a stock price will go down, but not drastically.

read morecovered calls, protective puts, stock index options example. These strategies may lead to lesser profits, but the risk is minimized greatly. This has been a guide to What is Index Options and its definition.

Here we discuss the types of index options, how it is priced along with calculation examples, advantages, and disadvantages, stock index options example. You can learn more about derivatives from the following articles —. Your email address will not be published. Save my name, email, and website in this browser for the next time I comment. Free Investment Banking Course.

IB Excel Templates, Accounting, Valuation, Financial Modeling, Video Tutorials. Login details for this Free course will be emailed to you. Forgot Password? Skip to primary navigation Skip to main content Skip to primary sidebar Skip to footer About Contact Login. Home stock index options example Risk Management Resources » Index Options. Article by Madhuri Thakur. Reviewed by Dheeraj Vaidya, CFA, FRM, stock index options example. What are Index Options? Leave a Reply Cancel reply Your email address will not be published.

Footer Company About Reviews Contact Privacy Policy Terms of Service. Resources Blog Free Courses Investment Banking Resources Financial Modeling Guides Excel Resources Accounting Resources Financial Statement Analysis. Courses Courses Financial Analyst All in One Course Investment Banking Course Financial Modeling Course Private Equity Course Venture Capital Course Excel All in One Course.

Please select the batch. Cookies help us provide, protect and improve our products and services. By using our website, you agree to our use of cookies Privacy Policy.

Are Index Options More Profitable or Stock Options? [Episode 167]

, time: 3:59Index Option Definition, Index Options Trading Examples

Besides common stock, there are also options for stock indexes, foreign exchange, agricultural commodities, precious metals, and interest rate futures Example of Index Options: The most popular index is the SP Index contract that trades with the ticker SPX. Here's a List of Most Active Index Options: DJX - Dow Jones Index; IWB - iShares Russell ® Indx Fund; IWD - iShares Russell ® Value Indx Fund; IWF - iShares Russell ® Growth Indx Fund; IWM - iShares Russell ® Indx Fund 04/11/ · Index options usually have a contract multiplier of $, meaning that the price of an index option equals the quoted premium times $ Unlike options in shares of stock or even commodities, it's not possible to physically deliver the underlying index to the purchaser of an index option. Thus, index options settle via cash payments

No comments:

Post a Comment