29/05/ · VIX Trading Strategies to Help You Trade Volatility VIX Index Explained. The VIX index, also known as the “fear index” is reported by the Chicago Board Options Exchange and Trading VIX Derivatives. Since traders can’t directly trade the VIX index, there’s a number of VIX Estimated Reading Time: 7 mins 16/04/ · VIX options also give you many more strategic alternatives and additional leverage to trading plain futures contracts. While trading VIX options may not be for everyone, option traders with a Estimated Reading Time: 11 mins While the Gorilla cannot recommend specific strategies for individual subscribers, keep in mind that in times of low volatility, like we are currently experiencing, it is a good idea for investors to buy calls or implement call spreads by using VIX options. The biggest advantage of VIX options is its negative correlation to the S&P Such a strategy enables an investor to diversify his/her portfolio and Estimated Reading Time: 3 mins

Option Strategies for All VIX Levels

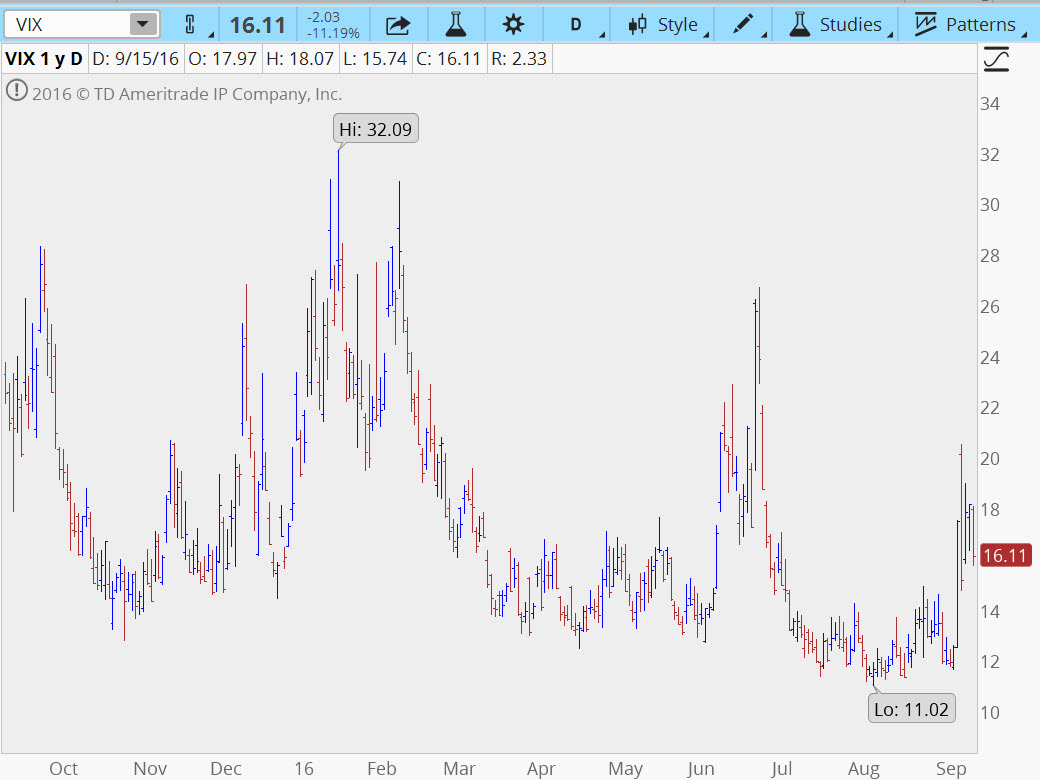

You can use option trades on the VIX to take advantage of the different moves and volatility in the broader markets. Playing this index long or short can take advantage of these moves without as much risk as in the outright buying or selling of the VIX futures. This trade is entered when I feel the VIX is much more likely to move higher than lower. An example of the structure of this Butterfly can be as follows:. I have had consistent profits with this strategy whenever the VIX begins to trade around 15 or even lower.

In the 12 to 14 area, you could also sell your Butterfly around the 14 strike. This trade is put on as a net credit and can be relatively inexpensive to adjust, based on the size of your risk tolerance. I often have this trade on near the options expiration. This trade is positive theta and the closer to expiration, the more time premium profit I will accumulate.

The trader can also speculate on the VIX, by simply buying long Calls or long Puts. They are often not very expensive. You could also buy long Call Verticals and long Put Verticals to decrease your capital outlay and your amount of risk, vix options trading strategies.

I have not utilized Time Spread strategies on the VIX and am not aware the risk or rewards of that type of set up. One other thing I would caution against, is being short on the upside of the VIX.

VIX upward moves are often quicker and much more dramatic than VIX moves, where volatility is lowering. If you decide to do this, be sure to have longs backing up any shorts and do not enter naked vix options trading strategies Calls. Be sure you understand VIX futures and VIX options well before you place any live trades. The CBOE market volatility Index, also known as the VIX, can be a very rewarding trading vehicle. One of my favorite strategies in the VIXis the Ratio Butterfly.

Ratio Butterfly Example This trade is entered when I feel the VIX is much more likely to move higher than lower. An example of the structure of this Butterfly can be as follows: With the VIX trading around the 15 level, you sell 4 VIX 15 Puts, buy 1 VIX 16 Put and buy 4 VIX 11 puts. Place all of these orders in the same expiration, vix options trading strategies, which is approximately 20 to 40 days from expiration, vix options trading strategies.

Positive Theta I often have this trade on near the options expiration. Upside of the VIX One other thing I would caution against, is being short on the upside of the VIX. Contact Us Sheridan Options Mentoring Corporation Revere Ave. Westmont, IL Email: info SheridanMentoring. com Phone: Accept Credit Cards. I have had a really good and it would not have been possible without your creating the classes and system to teach me the craft.

It has taken me the better part of 3 years to really figure it out and own it slow vix options trading strategies ;Obut I really feel like I can continue trading this way for the rest of my life. The hardest part for me was stopping the dumb mistakes, like "I hope, I hope, I hope" trading, thinking I was smarter than the market, and revenge trading trying to get my money back Disclaimer IMPORTANT NOTICE! The information contained on this website is for educational purposes only: no representation is being made that the use of any trading strategy or trading methodology will generate guaranteed profits.

Past performance is not necessarily indicative of future results. There is substantial risk of loss associated with trading options. Vix options trading strategies risk capital should be used to trade, vix options trading strategies.

Trading options is not suitable for everyone. You must be aware of the risks and be willing to accept them in order vix options trading strategies invest in these markets.

Market Prediction using INDIA VIX - All You Need To Know - P R Sundar

, time: 12:13How to Trade VIX Options: A Step-by-Step Guide • Benzinga

19/08/ · Vix Trading Strategies to Use. The VIX is a great trading tool. As a result, VIX trading strategies can be incredibly beneficial to traders. Especially if you know how to read charts. Make sure you spend the time needed to learn how to trade the VIX as well as using it as a tool. TTM Squeeze and VIX Trading Strategies. You can use the TTM Squeeze with VIX trading blogger.comted Reading Time: 8 mins 03/01/ · Regarding VIX options: Your brokerage account needs to be a margin account, and you need to sign up for options trading. There are various levels of option trading available (e.g., the first level allows covered calls). My experience is that to trade VIX options you will need to be authorized to trade at the second blogger.coms: 23 29/10/ · Option mentor Dan Keegan discusses different strategies that he uses depending on whether the VIX is at low or high levels. SPEAKER: My guest today is Dan Keegan and we are talking about the VIX and how you trade around it when it goes up and down. Dan, the VIX

No comments:

Post a Comment