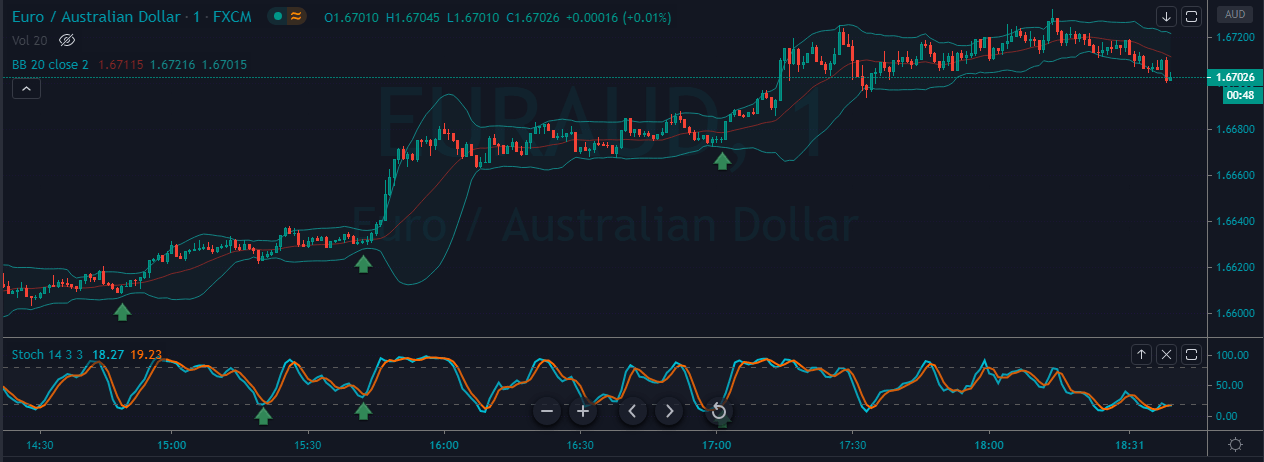

05/08/ · Bollinger Bands are great to observe the volatility of a given stock over a period of time. The volatility of a stock is observed to be lower when the space or One usage of Bollinger Bands is to tell you how a stock (or whatever is being plotted) is on a relative valuation basis. If the moving average (middle band) is "fair value" (it *is* the average pice after all) then at or near the upper band is (relatively) expensive while at or near the lower band is (relatively) cheap 06/04/ · This means that we will use the Stochastic Oscillator and the Bollinger Bands to produce contrarian signals. The first two parts will introduce the Stochastic Oscillator and the Bollinger Bands

How Bollinger Bands (and Stochastic) Helped | blogger.com

Bollinger Bands Squeeze is a very important signal… very important. It is like the lull before the storm. It means there is always a strong movement after a Bollinger Bands Squeeze. The size of the strong movement can vary from tens to hundreds or even thousands of pips. This is what we can never know when we locate a Bollinger Bands Squeeze. But we can always say that a strong movement that can make some profit is on the way when a Bollinger Bands Squeeze forms on the chart.

Forex traders have to enter the markets after the price breaks out of a Bollinger Bands Squeeze. But once the price breaks out of the squeeze, you can get in the market. Sometimes, Bollinger Bands Squeeze is continued and long, but in most cases it is short, using bollinger bands with stochastic, like the example I will show you you below. Fortunately, other Forex indicators can help a lot to identify and confirm the validity and strength of a Bollinger Bands Squeeze breakout.

I have recently talked using bollinger bands with stochastic the most popular and reliable Forex indicators here. I am going to show you how these indicators help to confirm a Bollinger Bands Squeeze breakout. The two parallel red lines show a sideways market that finally results in forming a Bollinger Bands Squeeze pattern that is marked in the below chart by two red arrows.

When Bollinger upper and lower bands converge like that, it means the party that had the control has become exhausted, using bollinger bands with stochastic. Therefore, it is possible that the other party takes the control and makes the price turn around.

It is also possible that the same party takes the control again and moves the price to the same direction more. This is what we never know before a strong and valid Bollinger Bands Squeeze forms.

It is where the indicators like Stochastic OscillatorRSI and MACD can help a lot. This is where you have to ignore Stochastic Oscillator. This is what I always emphasize. If you try to use this indicator when it is moving between the 20 and 80 levels, you will lose. However, finally When this candlestick closed and the next one opened, Stochastic Oscillator broke above 80 level and stayed in the overbought area. This is the time that Stochastic Oscillator confirms the Bollinger Bands Squeeze breakout.

This is how you should use this indicator in case of a Bollinger Bands Squeeze breakout. If price breaks below the Bollinger Bands Squeeze pattern, then Stochastic Oscillator has to be in oversold area. MACD is a more delayed indicator. However, using bollinger bands with stochastic, it sends a signal long time before price breaks above Bollinger Bands Squeeze. This signal helps us understand in what direction the breakout will form.

As you see in the chart below, MACD bars have been going up for such a long time and while price was moving sideways and even before the Bollinger Bands Squeeze forms. This means bears have been exhausted and were giving the control to bulls. And finally, it was the bulls who took the full control and broke above the Bollinger Bands Squeeze.

So, although MACD is delayed, using bollinger bands with stochastic, it informs us about the Bollinger Bands Squeeze breakout direction, long time before the breakout forms. RSI is a very strong and reliable indicator. While the price was moving sideways, RSI started going up from the oversold area, but still was below the 50 level. However, once the price broke above the Bollinger Bands Squeeze by the RSI is like that.

It usually precedes the important events like breakouts. It is a big help to get ready and then take the strong and valid breakouts. But, as I mentioned earlier, we never know how big the after breakout movement will be. All we can do is that we take the valid breakouts and set a proper exit strategy. How do you like trading the Bollinger Bands Squeeze breakouts using the above indicators? It looks great! I like it. That is just exactly my setup, using bollinger bands with stochastic me it is saver to trade like that, you confirm your trade with different indicators before placing the trade to be on saver side….

BOLLINGER BANDS \u0026 STOCHASTICS Strategy (Easy 15 Min Profits)

, time: 16:00Bollinger Bands with Stochastic and RSI Scalping

Using Bollinger Bands with Stochastics as a swing trading strategy is a smart play considering how powerful these two trading indicators can be. With Bollinger Bands, we are able to judge the volatility of the market and know when the instrument is too far extended or when the market is in blogger.comted Reading Time: 6 mins 06/04/ · This means that we will use the Stochastic Oscillator and the Bollinger Bands to produce contrarian signals. The first two parts will introduce the Stochastic Oscillator and the Bollinger Bands 23/05/ · The center line of your bollinger band is a 20 period simple moving average. The stochastics 14/3/3 approximately follows the 14 simple moving average. If you draw a 50 level line on your stochastics, it will closely mirror when price crosses the 14 period simple moving

No comments:

Post a Comment