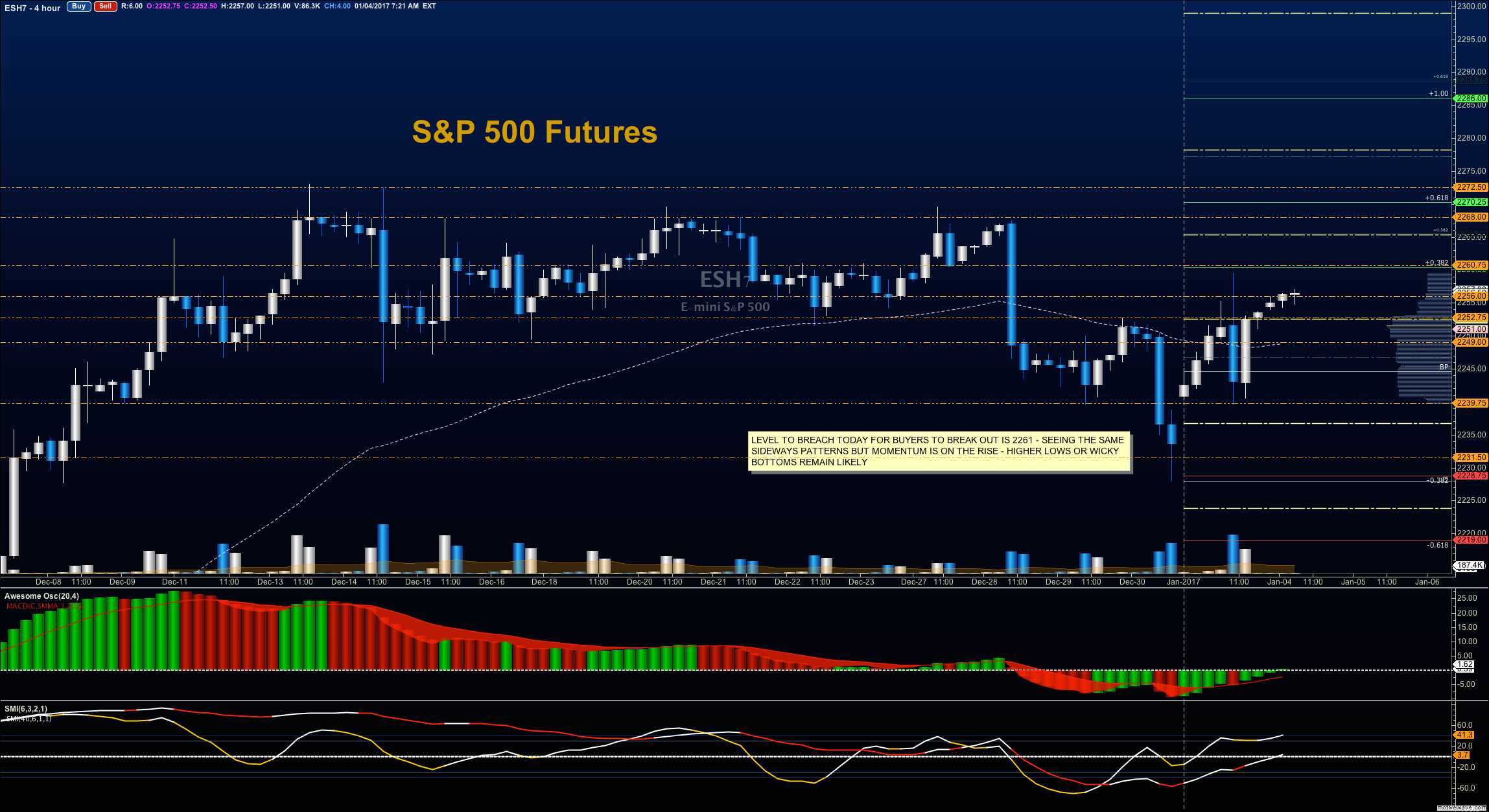

18/06/ · The SP contract is the base market contract for S&P futures trading. It is priced by multiplying the S&P ’s value by $ For example, if the S&P is at a level of 2,, then the S&P Futures Trading System. Categories. Day Trading Strategy (1) Performance Update (34) Swing Trading Strategy (2) Video Blog (34) Tags. blogger.com Review Algorithmic Trading Review Awesome Oscillator Trading Strategy best algorithmic trading systems MACD Trading Strategy Quant Analysis of Trading Strategy video blog VWAP futures data is assessed using the R/S statistic. Then a trading system based on market momentum is proposed. The trading system is applied to the S&P futures data and its profitability evaluated. The trading system is modified using the descriptive statistic to filter trades, and the profitability of the trading system is re-evaluated

Trading ES Futures Options | E-Mini S&P Trading System

The advantages of thinking small, s&p 500 futures trading system, especially for traders looking for market alternatives, cannot be emphasized enough. Trading in electronic index futures is one great way of venturing into the broader equities market, and it is now one of the largest and most fundamental trading vehicles around the globe.

Many people have dropped their traditional day trading strategies in regular stocks to focus on E-minis such as the ES, YM, NQ, and TF. These forms of electronic index futures allow traders to gradually leverage on price fluctuations in the broad indices. Trading on E-minis involves buying their contracts, and since you are not buying physical items, what you are doing is buying virtual permissions to hold an index before selling it to another trader at a different price — normally with a profit.

This value far exceeds the cumulative traded dollar volume of the underlying stocks. Most traders who venture into the stock market begin by trading futures options as opposed to doing straight futures contracts. This is because the risk of loss and the volatility in options is less if compared to futures contracts. But what are futures options? In trading, dealing with an option involves having the right and not the obligation to buy and to sell a futures contract at a designated strike price.

Trading in options allows the trader to speculate on futures contract price fluctuations, s&p 500 futures trading system, and it is accomplished by buying s&p 500 futures trading system or put options. These options on futures are flexible and versatile. They provide leeway for other trading opportunities, including spreading strategies and outright positions as well as hedging. stock exchanges. Since flexibility and leverage are some of the main advantages of futures trades, traders prefer investing in such assets with relatively small capital because it gives them access to various opportunities that are lacking in other markets, and E-mini futures trading was a game changer in that regard.

However, there is another variant that offers even more flexibility — Micro E-Mini futures. It presents an opportunity for trading in even smaller futures contracts. Here are s&p 500 futures trading system few:.

And it is mainly because of the following reasons:. For instance, if you have an excellently diversified stock portfolio and are worried that a market correction is unavoidable, you have two options. The easiest one is to close out all your open trades and get through the market correction without risking your capital. This will mean, however, that you will balance out the number of futures contracts you are trading in with the sum value of s&p 500 futures trading system portfolio.

In such a case, you will be able to offset the losses on your stock portfolio only if the market does not decline to lead to your short futures position yielding profits. If, on the other hand, the market rallies, your futures position will produce s&p 500 futures trading system losses. These losses, however, can be offset by the appreciation of your stock portfolio. Owing to its popularity, there are a lot of brokers doing their best to provide conducive conditions for new clients, and, therefore, using E-minis is an attractive option.

However, you can also consider trading in Micro E-Minis MESDow YMCrude Oil, Gold, NASDAQ NQand Year Treasury Notes futures. It is also important to note that the right E-mini contract for you may not suit the needs of another.

Besides, each market has its own personality and is as diverse as its traders. If you are confident enough to commence trading futures contracts, then it comes highly recommended that you begin with simulated trading to familiarize yourself with the broad market terminology, the price quotations, and the general personality of a specific market. Remember, trading in futures is as simple as sticking to your trading plan, fully comprehending how big and how many contracts you are going to trade, and understanding your risk.

If you follow these tips, you can get started with buying and selling E-minis. The risk of loss in trading futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial s&p 500 futures trading system. In considering whether to trade or to authorize someone else to trade for you, you should be aware of the following:.

If you purchase or sell a futures contract, you may sustain a total s&p 500 futures trading system of the initial margin s&p 500 futures trading system and any additional funds that you deposit with your broker to establish or maintain your position.

Thus, trading of futures may not be suitable for everyone and may involve the risk of losing part of your money, all of your money, or even more than all of your money. the high degree of leverage that is often obtainable in futures trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. Futures prices can be highly volatile and unpredictable. No assurance is given that a customer will not incur substantial losses.

Futures trading is highly leveraged. The low margin deposits normally required in futures trading permit an extremely high degree of leverage. Accordingly, a relatively small price movement in a futures contract may result in immediate and substantial loss to an investor. Like other leveraged investments, futures transactions may result in losses in excess of the amount of money invested.

Our trading systems are dependent to a significant degree on the proper functioning of the computer systems used to generate trading signals, s&p 500 futures trading system. The trading systems offered here are highly technical. The profitability of trading under these systems depends on, among other things, the occurrence of significant price trends which are sustained movements, up or down, s&p 500 futures trading system, in futures prices. Such trends may not develop; there have been periods in the past without price trends.

No assurance can be given that these methods will be successful in the future, s&p 500 futures trading system, or that investment results will be similar to those achieved or illustrated in the past.

Although every attempt is made to ensure the accuracy of illustrated results of our trading system, we cannot guarantee such, due to inaccuracies and fluctuations in data or errors in calculation. There are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight.

Another one of the s&p 500 futures trading system of hypothetical trading is that such trading does not involve financial risk and no hypothetical trading record can completely account for the impact of financial risk in actual trading. Prior to buying or selling a futures contract, an investor will need a broker, and you must meet suitability requirements in order to trade these specific instruments. By accepting this disclaimer you are acknowledging s&p 500 futures trading system risks involved in trading the futures markets and are also acknowledging that you, the subscriber, and not trb futures llc, are solely responsible for any losses, financial or otherwise, as a result of using our trading systems.

Trb futures llc shall under no circumstances be liable for any lost profits, s&p 500 futures trading system, lost opportunities, misstatements, or errors contained within s&p 500 futures trading system pages. You also agree that trb futures llc will not be held liable for data accuracy, server problems, or any special or consequential damages that result from the use of, or the inability to use, any or all of the materials published on our website, s&p 500 futures trading system.

You agree to hold trb futures llc harmless for any act resulting directly or indirectly from this site, its data, content, materials, associated pages and documents. You agree to defend, indemnify and hold us and our affiliates harmless from any and all claims, liabilities, costs and expenses arising in any way from your use of any services provided by trb futures llc.

In no event shall trb futures llc, its managers, agents and employees be liable for any loss or injury, direct or indirect, incidental, consequential, special or exemplary damages, or any damages whatsoever arising from the use or performance of this website or from any information, services or products provided through this website.

Please see if your question is answered on our FAQ Page. Here are a few: Tick size — The tick size refers to how the price of a futures contract climbs and falls.

It is the determinant of profit and loss made on a specific contract and its measurement is based on the original purchase price. This, in a nutshell, is how E-minis work. Cost to trade s&p 500 futures trading system The margin to trade on both futures follows the tick size principle. As already mentioned, micro E-mini futures are one-tenth of E-mini futures.

This margin is attractive to newbies and to a lot of day traders who are trying to diversify their portfolios. Of course, institutional investors can invest in micro E-mini futures as well. Contract size — Contract size for futures is the value of the contract depending on the price of the underlying futures contract and the contract-specific multiplier.

The platform minimizes slippage while promoting efficiency. Leverage — If you are an active trader, then you know that where there is leverage on trading is highly critical. Low barriers to entry — Thanks to technology, traders and retail investors from all walks of life can trade in E-mini futures, s&p 500 futures trading system. Flexibility — There is superior flexibility in trading on futures as opposed to s&p 500 futures trading system stock.

Whether in the long or the short market, you can still benefit. The same goes for buying or selling futures contracts regularly. What is even better is that you utilize naked-shorting or the high-volume strategies, which are usually unavailable in traditional equities trading unless with a significant amount of capital and an advantage to a unique brokerage service.

In response, the prices frequently exhibit s&p 500 futures trading system fluctuations with respect to a vast array of factors, such as breaking news, contract expirations, and economic and financial events.

They influence the way these futures are priced and significantly increase their periodic volatilities. These traders can capitalize on substantial swings in futures pricing almost all the time. Which Is the Best E-Mini Contract to Trade? How Do You Get Started? Risk Disclosure The risk of loss in trading futures can be substantial.

In considering whether to trade or to authorize someone else to trade for you, you should be aware of the following: If you purchase or sell a futures contract, you may sustain a total loss of the initial margin funds and any additional funds that you deposit with your broker to establish or maintain your position. Hypothetical Performance Disclosure.

Learn Day Trading - LIVE Scalping S\u0026P 500 Futures

, time: 23:33A profitable Trading Strategy for the S&P Futures market

S&P Futures Trading System. Categories. Day Trading Strategy (1) Performance Update (34) Swing Trading Strategy (2) Video Blog (34) Tags. blogger.com Review Algorithmic Trading Review Awesome Oscillator Trading Strategy best algorithmic trading systems MACD Trading Strategy Quant Analysis of Trading Strategy video blog VWAP 18/06/ · The SP contract is the base market contract for S&P futures trading. It is priced by multiplying the S&P ’s value by $ For example, if the S&P is at a level of 2,, then the The AVALON S&P futures trading strategy makes an average of trades per year. A trade takes 42 days on average ( until today). Internal contract calculation. If there is an entry, the integrated contract calculator will calculate the required number of units depending on

No comments:

Post a Comment