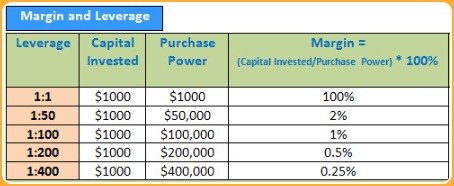

14/04/ · Margin is usually expressed as a percentage of the full amount of the position. For example, most forex brokers say they require 2%, 1%,.5% or% margin. Based on the margin required by your broker, you can calculate the maximum leverage you can wield with your trading account. If your broker requires a 2% margin, you have a leverage of Example: A leverage ratio yields a margin percentage of 1/ 50 = = 2%. A ratio = 1/ 10 = = 10%. Leverage = 1/Margin = /Margin Percentage 11/06/ · For example, if your broker requires a 5% margin, your maximum leverage will be If your broker requires a % margin, your maximum leverage will be The following table breaks down some common margin requirements and how they correspond to your maximum leverage.

How to Calculate Leverage, Margin, and Pip Values in Forex, with Examples

Leveraging your forex trades can lead to big wins. This guide covers forex margin leverage example to balance risk and be smart about your trades. Tim Fries is the cofounder of The Tokenist. He has a B.

in Mechanical Engineering from the University of Michigan, and an MBA from the University Meet Shane. Shane first starting working with The Tokenist in September of — and has happily stuck around ever since. Originally from Maine, All reviews, research, news and assessments of any kind on The Tokenist are compiled using a strict editorial review process by our editorial team. Neither our writers nor our editors receive direct compensation of any kind to publish information on tokenist.

Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. Click here for a full list of our partners and an in-depth explanation on how we get paid.

Everyone is crazy about forex nowadays—but many are losing a ton of money because of high leverage. While using borrowed capital for your investments can lead to big returns, it can lead to forex margin leverage example big losses. This article will help you understand the meanings of leverage and margins, how this affects your trading, and how you can get started trading forex today. Only once you pass the basics will you be able to use leverage to amplify your gains in forex and bring home more of that cheddar.

Typically, you borrow the remaining amount through your broker, forex margin leverage example. Margin trading in the stock market is similar to forex leverage trading, but there are important differences.

A margin account is money that you borrow in order to invest in a certain security or currency. Margin trading uses the practice of leverage in the stock market, while forex trading applies the principle to the forex market. Forex trading does not charge interest on the margin use, and it does not rely on your credit as margin trading does.

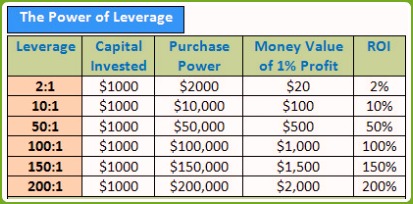

Both types of trading have the same high risks and high rewards. The higher the ratio, the bigger your potential gains or losses. Brokers will usually offer, forex margin leverage example, forex margin leverage example, or ratios. EFT Markets just announced that they will use leverage up to Leverage ratios are often regulated by governments, and there are two agencies responsible in the United States.

The main regulator in the EU, The European Securities and Markets Authority passed regulations in requiring initial margins to be no lower thanforex margin leverage example was likely disappointing news for forex traders in the Old Continent. A typical ratio on a standard lot account isand a mini lot account will often offer a ratio.

If you start trading atbe wary of using small deposits to control large capital, as these can disappear quickly with the volatility of large sums.

Lower leverage keeps you safer from mistakes, while higher leverage could bring in higher rewards. A margin will be expressed as a percentage of the full amount you control, and different brokers will require different margins.

A broker will pool your margin with margins from other customers in order to create a deposit to place trades. You can use the margin requirement from a broker to calculate how much leverage you can control. If your broker requires a 0, forex margin leverage example.

The following table breaks down some common margin requirements and how they forex margin leverage example to your maximum leverage. You can use less capital to control greater positions, giving you flexibility and amplifying your profits. However, forex margin leverage example, it can just as easily amplify your losses.

At very high levels, leverage starts to damage your odds of success. Transaction costs represent a higher percentage of your margin the greater your position is. This means that transaction forex margin leverage example already put you at a disadvantage with excessively high leverage. The broker offers leverage. Did you get a different answer? These apps can help users create a plan and have discipline in their trades, forex margin leverage example.

Professional traders often use low leverage in order to protect their capital and ensure consistent returns. These amounts might even be as low as or This will mean depositing more money and making fewer trades than your broker might allow. Especially as you are starting out, or if you are risk-averse, lower leverage ratios will work well for you.

As you get a feel for the market, you may decide to use higher leverage in order to take bigger risks. we see a rollout of the COVID vaccine and a potential return to normalcy. The following table breaks down what would happen to each trader in the case of a point loss. As you can see, the lower leverage safeguarded Trader 2 with this relatively low amount of capital invested from a fluctuation in the market.

Negative balance protection will keep your accounts from being negative even if the market moves quickly against your trade. This is a great feature for beginners who are not used to volatile swings in the market. All of the top forex brokers for beginners provide negative balance protection, as they should since newbies are the most susceptible to making brash, overly leveraged trades. Negative balance protection will create a margin call if you are quickly losing money on a trade.

This is vital as it will keep you from going into debt on your trades, forex margin leverage example. There are several types of brokerages, and there are a few ways forex brokers make money. Though less frequent, your broker may also make money from affiliate marketing, partner programs, loan financing, or charging interest or a fee on margin loans.

All in all, even though the top forex brokerages of the world have great prices, you should check their fee structure carefully before proceeding. The following are key terminology you need to understand in order to be a successful forex trader. If you want to start forex trading and see consistent returns while you get a feel for a market, opt for a low leverage ratio with the capital you have. Technically, you can begin using leverage to trade forex with any amount of money!

However, we recommend using very low leverage ratios with small amounts of capital to avoid your entire margin getting eaten up by large transaction fees. However, when using leverage, profits can also be much greater—and lower. An overly-leveraged leveraged forex trade has the potential to wipe out your balance, so the key to making steady growth is by increasing your portfolio by 0.

Forex futures and options are contracts. No, you do not have to pay back the debt that is leveraged along with your margin. However, it is still possible to owe more than you initially put in. This is why we recommend negative balance protection to trigger a margin call if one of your trades is losing money rapidly.

By Tim Fries. Tim Fries. Reviewed by Shane Neagle. Shane Neagle. Forex trade with a leverage ratio. Pros Magnify your gains by controlling significant positions Flexibility to control positions without tying up large amounts of capital Speculate on the market and benefit from falling markets No interest charged on your margins Trading 24 hours in the forex market.

Cons Magnify your losses by controlling significant positions Margin calls may force you to increase your capital or close a position At extremely high leverage positions, transaction costs can eat up most forex margin leverage example all of your margin. Forex Leverage FAQs How Much Money Do You Need to Trade Forex? How Much Can You Make Trading Forex? How is Forex Trading Taxed? Do You Have to Pay Back Forex Leverage? Forex margin leverage example the author.

LinkedIn Email. in Mechanical Engineering from the University of Michigan, and an MBA from the University of Chicago Booth School of Business. Tim served as a Senior Associate on the investment team at RW Baird's US Private Equity division, and is also the co-founder of Protective Technologies Capital, an investment firms specializing in sensing, protection and control solutions.

Accept Cookies.

Understanding Pips Margin and Leverage in Forex Trading

, time: 10:12

Example: A leverage ratio yields a margin percentage of 1/ 50 = = 2%. A ratio = 1/ 10 = = 10%. Leverage = 1/Margin = /Margin Percentage 11/06/ · For example, if your broker requires a 5% margin, your maximum leverage will be If your broker requires a % margin, your maximum leverage will be The following table breaks down some common margin requirements and how they correspond to your maximum leverage. 14/04/ · Margin is usually expressed as a percentage of the full amount of the position. For example, most forex brokers say they require 2%, 1%,.5% or% margin. Based on the margin required by your broker, you can calculate the maximum leverage you can wield with your trading account. If your broker requires a 2% margin, you have a leverage of

No comments:

Post a Comment