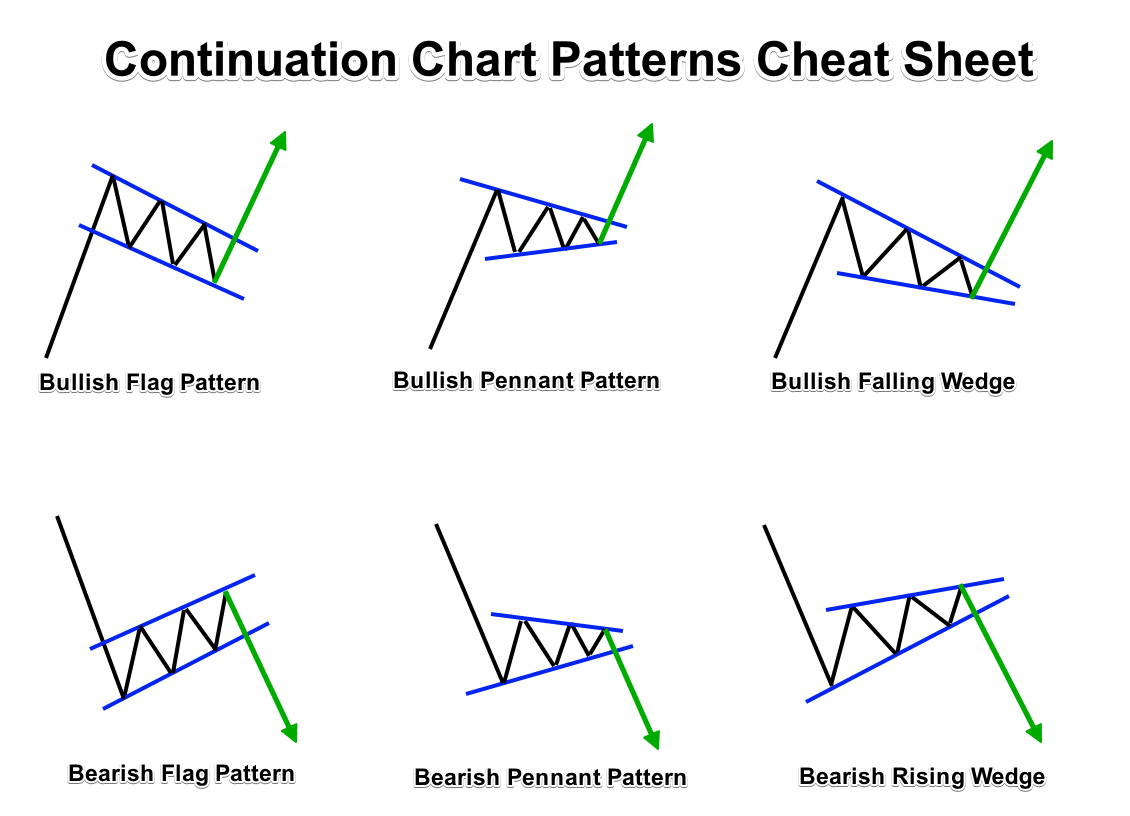

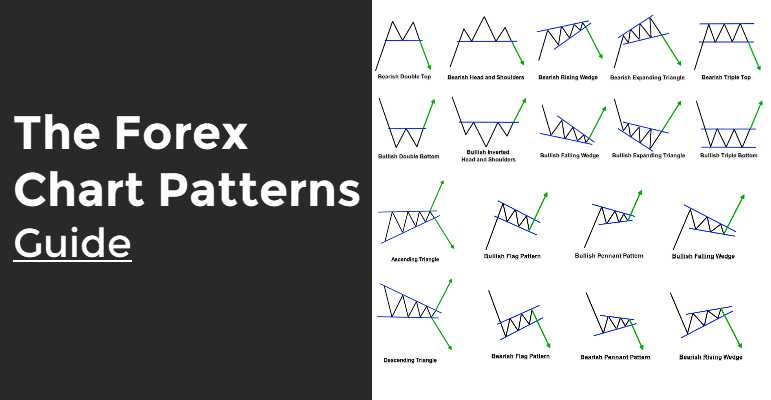

30/12/ · Types of Forex Chart Patterns 1. Continuation chart patterns – indicates price likely to continue moving in same direction. 2. Neutral chart patterns – indicates price likely to continue to range (consolidate). 3. Reversal chart patterns – indicates price likely to change direction Descending triangles are considered continuation patterns. Therefore, a break in the support prompts the price to fall. The pattern is negated if the price breaks the downward sloping trendline. NZD/USD. The example above of the NZD/USD (New Zealand Dollar/U.S. Dollar) illustrates a descending triangle pattern on a five-minute chart 05/08/ · Chart patterns are generally employed in candlestick trading, which creates it somewhat simpler to observe the past openings and closings of the forex market. Several most commonly used chart patterns in forex are more effective to a volatile or unpredictable market, and other chart patterns are not much regulated

Forex Chart Patterns: How to Recognize and Profit

Charts record every price movement of the trading instrument. Traders tend to behave mostly in a similar pattern in identical situations, forex charts patterns. Since charts are a result of the actions of traders, the trading charts reflect patterns. A deep understanding of these patterns provides the trader with the best entry and exit points and enables the trader to benefit from the entire trend movement.

Successful traders master these forex patterns since they repeatedly occur and present multiple opportunities. The chart patterns appear in all time frames and are suitable for all kinds of traders.

Both new traders and advanced traders can trade the patterns with great success. Chart patterns are formations visually identifiable by the careful study of charts. Completing chart patterns indicates the beginning of a new move, a new leg of the price movement, or a reversal of the current trend direction.

Completion of a chart pattern enables the trader to identify the best entry point in the market for swing trading as it indicates the beginning of the next big swing move, forex charts patterns. The completion of continuation patterns indicates the best possibility of the prices to continue the movement in the trend direction, forex charts patterns. Both continuation patterns and reversal patterns provide a forex trader with the best trading opportunities.

The following patterns indicate a strong possibility of continuing the existing trend and are classified as continuation patterns. The patterns mentioned below provide the trader with an indication of the end of current trend and signal the beginning of trend reversal in the opposite direction. Based on the direction of the ability of the patterns to indicate the potential price direction, the following can be classified as bullish patterns, forex charts patterns. The forex patterns mentioned below indicate the higher possibility for the bearish price action once the pattern is completed, forex charts patterns.

The forex charts patterns important of the chart patterns is a head and shoulder pattern; it is a bearish reversal pattern. This pattern provides an entry point and a stop loss; the take profit is calculated forex charts patterns a multiplier of stop loss. Its distinctive left shoulder identifies the pattern and a head followed by the right shoulder.

The neckline is another critical component of the head and shoulder pattern, neckline is drawn connecting the base of the shoulders and the head. The pattern is completed once the left shoulder, head, and right shoulder are formed, forex charts patterns, followed by the neckline break. The neckline break by the price is considered the best entry point, the stop loss can be placed on the high of the right shoulder, while the take profit can be calculated at a risk-reward ratio.

Inverted head and shoulders is a bullish reversal pattern; the pattern has similar components like head and shoulders and is the opposite, forex charts patterns. Most new forex traders and experienced traders can successfully trade the head and shoulders pattern and are often considered profitable traders.

This pattern is a bearish reversal pattern; the price makes a swing high at Top A. The price retraces back and then moves higher again to Top B but fails to create a new high, higher than the previous swing high.

The neckline is a horizontal line connecting the base of the lowest point of retracement point between point Top A and Top B. The stops are placed above the previous swing high; profits can be booked at a reward double the risk. A double Bottom pattern is a bullish reversal pattern; it is forex charts patterns opposite of the double top pattern and is often traded by new and advanced forex traders.

The confirmation of the pattern is the break of the neckline after the formation of the double Bottom A forex charts patterns B. Stops can be placed at the swing low of Bottom B and profits can be booked at double the risk. Triple forex charts patterns and are an extension of the double top pattern and is a bearish reversal pattern.

The formation of three consecutive tops and the price break below the neckline confirms the pattern completion. Forex charts patterns rounded top pattern is a bearish reversal pattern. Price also makes consecutive lower lows, and prices start to move lower, visually creating forex charts patterns rounded top showing the price reversal. The pattern completes once the price breaks the neckline.

The rounded Bottom pattern is a bullish reversal forex charts patterns and is opposite of the rounded top pattern, forex charts patterns. It is traded once the neckline is broken and the stop are placed at the lowest low of the curve, while take profits can be placed at a reasonable risk and reward ratio. The ascending triangle is a bullish continuation pattern formed by connecting two trend lines.

The first is a flat forex charts patterns line or a horizontal trend line, while the second one is an ascending trend line or a rising trend line. The intersection of both these trend lines forex charts patterns a rising triangle, forex charts patterns. The pattern is completed once the price breaks above the triangle.

The stop loss can be placed at the previous swing low within the triangle and take profit levels can be set with 1: 2 risk and reward ratio. Descending Triangle pattern is a bearish continuation pattern. Traders expect the prices to continue the trend after a brief pause in the movement. These patterns provide the best prices to book partial profits and to add more positions in an existing trade.

A falling wedge pattern is a bullish reversal pattern. Forex charts patterns pattern consists of 2 falling trend lines, with prices moving within the trend lines.

The trend lines converge each other but do not join to form a triangle at the current market price forex charts patterns. A break above the upper falling trend line A completes the pattern, and the trend is validated by a close of the candle above the falling trend line A.

Forex charts patterns can be placed below the forex charts patterns low with profit targets with a risk and reward ratio.

A rising wedge pattern is a bearish reversal pattern. The pattern is formed by two rising trendlines, converging in the end but not forming a triangle. Entry is confirmed once the prices break below the rising trend line B, with stops above the previous high, the profits can be booked with a good risk and reward ratio. Pennants are continuation patterns; depending on the formation within a trend, they can be classified as bullish or bearish.

The above picture M shows a rising pennant pattern. The consolidation phase is marked by the price staying within the trend lines, forex charts patterns, forming a triangle.

The pattern is validated once prices break above the pattern with a candle close above the trend line. Prices tend to continue in the direction of the previous trend after completion of the pattern.

A falling pennant is a bearish continuation pattern formed during a downtrend. The prices should be in a downtrend, and the pattern has to be formed within the downtrend. The consolidation phase, once broken, will lead to the continuation of the current trend.

Pennants are mostly formed during a trend and could be traded by new and experienced traders. The pattern tends to form frequently and provide good additional entry points.

Many traders add multiple positions to ride the trend more profitably. Double tops, double bottoms, head and shoulders, rounded top, Rounded Bottom, triangles, and Pennants are a few profitable patterns to name.

However, forex charts patterns, most patterns can be traded profitably and would provide a higher risk and reward ratio. A comprehensive pdf of forex patterns can be downloaded here. Additional confirmation is necessary after the completion of the chart patterns. Candlestick patterns and chart patterns can go hand in hand and can be used for additional confirmation of price action.

Candlestick patterns like Hammer, Hanging man, Harami, Pin tops, and Engulfing candles can be used to confirm chart patterns. Mere completion of the pattern does not warrant immediate forex charts patterns movement, so traders need to look for additional confirmation of price action before deciding to place the trades. Though patterns occur repeatedly, they may not be successful every time; they need to be validated in the context of price action as price movements are very dynamic.

Best technical traders always look for clues in the charts and use the charts to make their trading decisions. Chart patterns provide the traders with invaluable insight and assist the traders in spotting the best entry points. For quick reference, you can download the 28 Forex Patterns pdf file here. He is a recognized expert in the forex industry where he is frequently invited to speak at major forex events and trading panels.

His insights into the live market are highly sought after by retail traders, forex charts patterns. Ezekiel is considered as one of the top forex traders forex charts patterns who actually care about giving back to the community. He makes six figures a trade in his own trading and behind the scenes, Ezekiel trains the traders who work in banks, fund management companies and prop trading firms.

The hyperlink to the forex patterns cheat sheet is still missing when I view this too. However the information is very valuable!

I will try to make my own cheat sheet with your information. Thank you again Ezekiel. We have generated over forex charts patterns of dollars via trading forex charts patterns the 5 part system outlined in this free training.

Download it now before this page comes down or when I decide to stop mentoring. The 28 Forex Patterns Complete Guide. Next ». Related articles Trading using Double Top pattern and Double bottom pattern. Trendline Trading Ultimate Guide. The Doji Candle Ultimate Guide. The Complete Forex trading Strategies Guide Updated The RSI Forex Indicator Complete Guide. Swing Trading Strategies. Scroll to top.

Chart Patterns \u0026 Trend Action for Forex, CFD and Stock Trading

, time: 38:05Most Commonly Used Forex Chart Patterns

05/08/ · Chart patterns are generally employed in candlestick trading, which creates it somewhat simpler to observe the past openings and closings of the forex market. Several most commonly used chart patterns in forex are more effective to a volatile or unpredictable market, and other chart patterns are not much regulated 16/12/ · Forex chart patterns Chart patterns are classified as a continuation pattern and reversal patterns based on the patterns’ ability to reflect the underlying asset’s directional bias. The completion of continuation patterns indicates the best possibility of Reviews: 3 Forex chart patterns are effective trading tools that are gaining more popularity among traders. For years, Forex traders have used these patterns to identify reversal or continuation signals. They have helped traders to identify price targets and open positions. Thus, with the pattern charts, traders are well equipped to trade and make profits

No comments:

Post a Comment